Life > Get good grades + Earn good money

Most of us study hard to get good grades, learn a skill, work to earn money and save. Many assume we will be healthy, and work until retirement to enjoy life. Ironically, we are not taught what to do with the money earned and saved. Some may be taught by our parents with whatever they know. This is too life-critical a subject not to be taught and left to be figured out ourselves.

If I were young again, the first thing I would do is learn to save money as much as possible to retire as young as possible. The pace of innovation is getting faster and may make what we studied and our jobs obsolete, this reinforces the need to save as much money as possible.

This article is based mainly on 2 great books I read.

- Your Money Or Your Life by Vicki Robin and Joe Dominguez

It provides a very interesting insight into defining money, our relationship with money and a very useful framework to work towards financial independence. - The Psychology of Money by Morgan Housel

It explains that our behaviour and psychology have a major influence on earning, spending, and thinking about money and how it relates to our social status, greed, and fear in our own preferred manner.

Definitely, with a better understanding of money through books and personal experience, penning them into articles will provide a useful guide to our kids and many others through their life journey; avoiding the unnecessary and painful mistakes we had.

Instead of buying your children all the things you never had, you should teach them all the things you were never taught. Material wears out but knowledge stays.

Bruce Lee

When you grow up you tend to get told that the world is the way it is, and your life is just to live your life inside the world. Try not to bash into the walls too much. Try to have a nice family, have fun, save a little money. That’s a very limited life.

Life can be much broader once you discover one simple fact. And that is, everything around you that you call life was made up by people that were no smarter than you. And you can change it, you can influence it, you can build your own things that other people can use. Once you learn that, you’ll never be the same again.

Steve Jobs

Our job ≠ Our identity

When we were young and were asked: What do we want to be when we grow up? Our response would be the profession and career with a good salary that we would like to pursue.

When people ask: What do we do? What do we do for a living? We would reply to what we work as; what is our job.

Unconsciously, our life is synonymously linked to a job or a profession. As Vicki Robin and Joe Dominguez explained in their book, Your Money Or Your Life, we are so wedded to what we do to “make a living” that we perpetuate, without thinking, this confusion of doing with being. Indeed, in terms of sheer hours, we may be more wedded to our jobs than to our family and friends and other interests we love and believe in. The vows for better or worse, richer or poorer, in sickness and in health — and often till death do us part — may be better applied to our jobs than our wives or husbands. No wonder we introduce ourselves as nurses or contractors rather than as parents or friends. Life is not just about earning money. Profession and our money-earning capacity are not a measure of life, an identity or a validation of us and our worth.

For many: Money earned = Money spent = Our identity

Actually: Money saved = Wealth

Everyone knows how to spend money. There are many things we like and would like to have. There is a lot of sales and marketing to lure us to spend and upgrade to the latest products. We also like to spend to impress and to reflect our social status; a social comparison of sorts.

We judge our own and others’ importance by material yardsticks — the size of our paychecks, the size of our houses, the size of our portfolios. We “size” each other up and feel one-up or one-down on the basis of these barely conscious assessments. From the citywide perspective, this informal caste system becomes quite apparent — in others and in ourselves.

Vicki Robin and Joe Dominguez Your Money Or Your Life

Money as “The greatest show on earth”

Morgan Housel called money “the greatest show on earth” because of its ability to reveal things about people’s character and values.

There are two ways to use money. One is as a tool to live a better life. The other is as a yardstick of status to measure yourself against others. Many people aspire for the former but get caught up chasing the latter.

There is a paradox here: people tend to want wealth to signal to others that they should be liked and admired. In reality, those other people often bypass admiring you, not because they do not think wealth is admirable, but because they use your wealth as a benchmark for their own desire to be liked and admired.

Money is a tool you can use. But if you’re not careful, it will use you. Sometimes the stuff you spend money on has so much influence over your autonomy and sanity that it’s not clear whether you own things or the things own you. Rather than using money to build a life, your life is built around money.

Less ego, more wealth. Saving money is the gap between your ego and your income, and wealth is what you don’t see. So wealth is created by suppressing what you could buy today in order to have more stuff or more options in the future. No matter how much you earn, you will never build wealth unless you can put a lid on how much fun you can have with your money right now, today.

Morgan Housel

The world judges us by what we have (car, house, our corporate position) and do not have. The world judges us the car we drive, the house we stay, the title you have. Every few people want to talk to me if I am not the CEO. I am very clear of that….

Our response: Get out there to get what you need so that the world will listen to you and you have a chance to impact the world….

Do not judge the world based on what they have and do not have because that is wrong. We should not judge a person based what a person has and does not have materially.

And do not let others judge you by what you have and do not have because that is not our identity.

Christopher Tan, Providend

There is no need to prove ourselves. Don’t try to look wealthy. There is no need to buy expensive stuff with our hard-earned money to impress people we do not know or whether they care about us. Be wealthy.

We assume we will be healthy and have the capacity to work (and earn) until retirement, we have many years of monthly income streams ahead. Also, in many countries, there are retirement funds that should be able to take care of our old age to some extent. Hence, with about 40 years of working and earning capacity, most of us, especially when young, indulge in instant gratification to spend more especially when our conviction for savings is weak and unclear. Saving is boring; they are just numbers in our bank accounts. We will give reasons to buy the latest iPhone. Thereafter, we will give reasons to buy and keep upgrading to the latest sneaker, the latest phone, the latest car, a bigger house, etc. The result is lifestyle inflation when our spending increases with the rise of our income. Saving can wait.

Most of us do not know how much is enough. We have endless desires. Our money, limited by our earning capacity, will never be enough to satisfy our unlimited desires. Hence, we will be stuck in the corporate thread mill (whether we like our job or not), addicted to our monthly salary, and clinging to social status; always in an earning and spending cycle mode until retirement. Being employed with our monthly paycheck gives an illusional sense of security.

Worse, by not knowing what is enough, we can become more greedy. We want to have more money faster; we may take unnecessary risks — we speculate, we gamble, we leverage, we cheat.

We need to know what and how much is enough.

By not knowing what is enough, the end results is regret. — Morgan Housel, The Psychology of Money

A good financial skill is valuing your independence tomorrow more than your possessions today. — The Motley Fool

Save your money and build wealth.

More importantly,

More money ≠ More happiness

Happiness = Reality – Expectations

Knowing enough = Contentment 🙏

We keep looking for what we do not have and are not content with what we have.

By knowing what is enough, we will spend less, and save and invest more consciously. To spend less is to control and manage our desires. Our desires can be in several major categories: Are we spending money to impress others or to make ourselves and our family happy? Hence, spending less can translate to caring less about what others think of us — remove the desire to prove oneself to others, remove attachments to possessions, be contended, and live humbly and simply.

Secrets to happiness is gratitude. Envy poisons happiness. I am grateful for what I have and not envy for what I do not have. I am grateful for my amazing marriage, good health, great friends and amazing business. — John Mackey, Founder and CEO, Whole Foods

“Good health, longevity, happiness, a loving family, self-reliance, fine friends … if you [have] five, you’re a rich man….” ― Thomas J. Stanley, The Millionaire Next Door: The Surprising Secrets of America’s Wealthy

Brian Stoffel, an analyst from Motley Fool, uses a question to ask ourselves whether we have enough: If this thing disappeared from my life, one year later, would it really make a difference?

And a litmus test to measure our level of Enough: How would this change things one year from now?

In many instances, we want more and better of the same things. We need clothes; we want more branded and nicer clothes. We need a mobile phone; we want the latest model. We need a house; we want a bigger and better house. Most items are made to last but we do not use them until they are spoilt or are beyond repair. We are often upgrading and caught in the wheel of consumerism. Many are driven by envy and greed.

“People don’t need enormous cars; they need respect. They don’t need closetsful of clothes; they need to feel attractive and they need excitement, variety, and beauty. People need identity, community, challenge, acknowledgment, love, joy. To try to fill these needs with material things is to set up an unquenchable appetite for false solutions to real and never-satisfied problems. The resulting psychological emptiness is one of the major forces behind the desire for material growth. A society that can admit and articulate its non-material needs and find non-material ways to satisfy them would require much lower material and energy throughputs and would provide much higher levels of human fulfillment.”

Donella Meadows

“I am not impressed with what people own. But I’m impressed with what they achieve. I’m proud to be a physician. Always strive to be the best in your field…. Don’t chase money. If you are the best in your field, money will find you.”

Thomas J. Stanley, The Millionaire Next Door: The Surprising Secrets of America’s Wealthy

More money is better; this is a belief that many have and drive us throughout our lives. The “more” that was supposed to make life “better” can never be enough. More is not necessarily better, while “enough” is both supremely fulfilling and achievable. This is an important tenet towards a financial independence mindset.

The letter I wrote after my son was born said, “You might think you want an expensive car, a fancy watch, and a huge house. But I’m telling you, you don’t. What you want is respect and admiration from other people, and you think having expensive stuff will bring it. It almost never does — especially from the people you want to respect and admire you.”

My point here is not to abandon the pursuit of wealth. Or even fancy cars. I like both.

It’s a subtle recognition that people generally aspire to be respected and admired by others, and using money to buy fancy things may bring less of it than you imagine. If respect and admiration are your goal, be careful how you seek it. Humility, kindness, and empathy will bring you more respect than horsepower ever will.

Morgan Housel, The Psychology of Money

More money saved = More life energy = More freedom

The best use of money is to buy control of your time.

The highest form of wealth is the ability to wake up every morning and say, “I can do whatever I want today.”

Morgan Housel, The Psychology of Money

In the book, Your Money Or Your Life by Vicki Robin and Joe Dominguez, money is defined as something we choose to trade our life energy for. Our lives are finite, life energy is our allotment of time here on Earth, the hours of precious life available to us. Life energy also includes positive and negative emotions (joy, happiness, stress, frustration, anger) that we have with the job. When we go to our jobs, we are trading our life energy for money. Hence, if money equals life energy, then by increasing your income you increase the amount of life available to you. If money and physical possessions determine our “worth”, we need to evaluate the worth of the time that we pay for in return for money. We “pay” for money with our time. We choose how to spend it.

Net worth is measured in dollars. Wealth is measured in free time.

Brian Feroldi

According to Morgan Housel, the highest forms of wealth are measured differently:

- Controlling your time and the ability to wake up and say, “I can do whatever I want today.”

- When money becomes like oxygen: so abundant relative to your needs that you don’t have to think about it despite it being a critical part of your life.

- A career that allows for intellectual honesty.

Wealth is what we earn and do not spend. Bit by bit, we achieve some degree of independence and autonomy that gives us greater control over what and when we can do. That flexibility and control over our time is an unseen return on wealth.

In short, money represents the amount of time and resources we expend to earn them, and correspondingly, having money represents freedom and control over our time.

As we gain more wealth and do not keep upgrading our wealth, what we gain is freedom.

More money ≠ Better

The Fulfilment Curve as illustrated in the book, Your Money Or Your Life shows the relationship between the experience of fulfilment and the amount of money we spend (usually to acquire more possessions). At the beginning of our lives, more possessions did indeed mean more fulfilment. Basic needs were met. We were fed. We were sheltered. We then went from bare necessities (food, clothing, shelter) to some amenities (toys, a wardrobe, a bicycle), and the positive relationship between money and fulfilment became even more deeply embedded. Eventually, we slipped beyond amenities to outright luxuries such as a car, overseas travel, luxury watches, and clothes — and hardly registered the change. Notice that while each one was still a thrill, it cost more per thrill and the “high” wore off more quickly.

While money gives us fulfilment, the curve has started to level out. More money brought more worry. More time and energy commitments as we rose up the corporate ladder. More time away from the family. We hit a fulfilment ceiling and never recognized that the formula of money = fulfilment not only had stopped working but had started to work against us. No matter how much we bought, the Fulfilment Curve kept heading down. We do not need more to be happy. We will realize that the material goods bought are like dopamine that gives us temporary satisfaction and pleasures to motivate us to keep going in the corporate rat race. Philip Brickman and Donald T. Campbell coined the term “hedonic treadmill”, also known as a hedonic adaptation to describe a similar observation

Hence, at the peak of the Fulfilment Curve, we have enough — enough for our survival, comforts, and even enough for little “luxuries.

The idea of optimal net worth is…[when] more money, not only does not make [you] happier, it might be like the inverted U: It starts to decrease [your] happiness.”

Morgan Housel

Several possibilities for how more money decreases our happiness:

- The hedonic treadmill keeps you lusting for more without any satisfaction.

- Your kids grow up spoiled and detached from reality.

- Your relationships deteriorate as your elevated net worth creates distance from those in your orbit.

Personal finance:

Personal > Finance and

Reasonable > Rational

Personal finance is more personal than it is finance. — Tim Maurer

We are all different. We have different circumstances, risk appetites, temperaments, emotions, preferences, needs, priorities, and goals as well as different levels of understanding and experience in finance, investment, and money management. This will greatly influence our decision-making on personal finance. What works for someone may not be preferred by another.

Academic finance, as explained by Morgan Housel, is devoted to finding mathematically optimal investment strategies. There are rational financial approaches to making money through formula and spreadsheet computations. Such rational academic approaches assume that we have no feel for a roller coaster ride (i.e. volatility) that may result in temporary unrealized losses, especially in a longer time frame. We have feelings and may not be able to act rationally like robots that the calculations and approaches require us to be.

We may simplify and adapt the approach to our preferences so long as it works comfortably and is reasonable for us to achieve our financial objectives. First, we must start with a goal in mind and an approach.

Personal finance is personal because what is enough is a state of mind.

Life is for living

Life > Money

Contentment ≠ No ambition

Life is not all about earning money. Job is not our identity. The objective is not running the fastest in the corporate race; rather, it is about finishing it earliest and achieving financial freedom. Money is meaningless if one cannot enjoy the benefits that come with money.

The objective is not running the fastest in the corporate race; rather, it is about finishing it earliest and achieve financial freedom.

The 14th Dalai Lama summed it up aptly when asked what surprised him most about humanity:

Man. Because he sacrifices his health in order to make money. Then he sacrifices money to recuperate his health. And then he is so anxious about the future that he does not enjoy the present; the result being that he does not live in the present or the future; he lives as if he is never going to die, and then dies having never really lived.

A related post worth reading: Embracing the finiteness of life and what remains

事能知足心常泰, 人到无求品自高

陈白崖

We should not pursue or pursue less envy, material things, power and authority. Instead, we should pursue knowledge, learnings, friendship, and relationships and contribute to family, friends and society. Money is not the be-all; or end-all of life. Being contented does not mean being not ambitious. It is more than doing what is right and nice; it is about doing what is needed to achieve the goals. Stay disciplined and focused. Be mature and magnanimous with a positive attitude; there will be things and people we do not like that we have to deal with.

Life is more than about money. Money is a tool, earn and use it well.

Towards Financial Independence

The book, Your Money Or Your Life, explains in detail the 9 steps (listed in a section below) towards transforming our relationship with money and achieving financial independence.

As explained earlier, many unconscious basic assumptions we adopted may be flawed. The 9 steps examine these assumptions, make peace with our past (no shame, no blame) and re-develop our relationship with money, and steer towards financial independence thinking and living. We need to make peace with the past as we realize how we can track and make better use of our money, time, and energy.

As defined by the book, Financial Independence is defined as having a regular income sufficient for our basic needs and comforts from a source (for example, investment returns built up using our savings) other than paid employment where we are freed to leave. Financial Independence is the experience of having enough — and then some.

Financial independence has nothing to do with being rich. Financial independence is an experience of freedom at a psychological level. We are free from slavery to unconsciously held assumptions about money, and free of the guilt, resentment, envy, frustration, and despair we may have felt about money issues. Furthermore, it will allow us to examine and pursue our life purpose and meaning, and cherish relationships. It is better late than never to embark on this financial independence journey.

“Most people fail to realize that in life, it’s not how much money you make, it’s how much money you keep.” ― Robert T. Kiyosaki, Rich Dad, Poor Dad

A great post from Morgan Housel: A Few Thoughts on Spending Money

9 Steps to Financial Independence

The book, Your Money Or Your Life, explains in detail the 9 steps towards transforming our relationship with money and achieving financial independence.

Step 1: Making peace with the past

A. Find out how much money you have earned in your lifetime — the sum total of your gross income, from the first penny you ever earned to your most recent paycheck.

B. Find out your net worth by creating a personal balance sheet of assets and liabilities. What do you have to show for the money you’ve earned?

Step 2: Being in the Present — Tracking Your Life Energy

A. Establish (accurately and honestly) how much money you are trading your life energy for, and discover your real hourly wage. — how much money are you making for the amount of time you work?

Think of all the ways you use your life energy that is directly related to your money-earning employment. Think of all the monetary expenses that are directly associated with the job. In other words, if you didn’t need that money-earning Job, what time expenditures and monetary expenses would disappear from your life?

B. Learn about your money behaviour by keeping track of every cent that comes into and goes out of your life.

Recognizing and telling the truth about our irrationality around money and our addictive behaviour is simply the first step toward sanity. This program is based on consciousness, fulfilment, and choice, not on budgeting or deprivation. All you have to do is be conscious.

It’s about identifying, for yourself, what you need as opposed to what you want, what purchases or types of purchases actually bring you fulfilment, what represents “enough” to you, and what you actually spend money on. This program is based on your reality, not a set of external norms. Consequently, the success of this program rests on your honesty and integrity.

Step 3: Monthly Tabulation

1. Discern your unique spending and income categories and subcategories from the month’s worth of entries in your Daily Money Log.

2. Set up your Monthly Tabulation.

3. Enter all money transactions in the appropriate category.

4. Total money spent in each subcategory.

5. Add up total monthly income and total monthly expenses. Total your cash on hand and balance all bank accounts. Apply the equation (total monthly income minus total monthly expenses plus or minus monthly error) to see how accurate you’ve been. The money you actually have at the end of the month should equal what you had at the beginning plus your monthly income minus your monthly expenses.

6. Convert the “dollars” spent in each subcategory into “hours of life energy,” using the real hourly wage that you computed in Step 2.

The fun — and challenge — of this step will come in discovering your own unique spending categories and subcategories. These subcategories will be like a dictionary of your unique spending habits. They will be perhaps your most accurate description to date of your lifestyle, including all your peculiarities and peccadilloes.

This detailed portrait of your life is your true bottom line. Forget the mythology of your life. Forget the story you tell yourself and others. Forget your résumé and the list of associations you belong to. When you do Step 3 you will have a clear, tangible mirror of your actual life — your income and expenses over time. In this mirror, you will see exactly what you are getting for the time you invest in making money.

Step 4: Three Questions That Will Transform Your Life

In this step, you evaluate your spending by asking three questions about the total spent in each of your subcategories:

1. Did I receive fulfilment, satisfaction, and value in proportion to the life energy spent?

2. Is this expenditure of life energy in alignment with my values and life purpose?

3. How might this expenditure change if I didn’t have to work for a living?

The very process of asking and answering the three questions month in and month out will clarify and deepen your understanding of fulfilment and purpose.

Step 5: Making Life Energy Visible

Make and keep up-to-date a chart of your total monthly income and your total monthly expenses.

Step 6: Valuing Your Life Energy — Minimizing Spending

Lower your total monthly expenses by valuing your life energy and increasing your consciousness in spending. Learn to choose the quality of life over the standard of living.

Step 7: Valuing Your Life Energy — Maximizing Income

Increase your income by valuing the life energy you invest in your job, exchanging it for the highest pay consistent with your health and integrity.

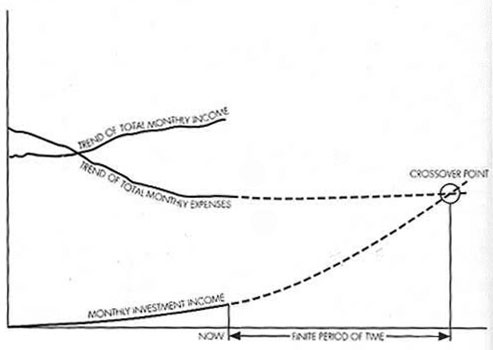

Step 8: Capital and the Crossover Point

Each month, apply the following formula to your total accumulated capital and record the result:

Step 9: Managing Your Finances

Become knowledgeable and sophisticated about long-term income-producing investments and manage your finances for a consistent income sufficient to your needs over the long term.

4 things to note

1. Expect a long, difficult, and bumpy ride ahead

The journey will be not smooth. We will be lost in the process. There will be challenges. We may take some time to find our interests and footing on our investment approaches. Investment returns will get negative and less than desired. There will be periods where the unexpected happens which causes detours and pains. We just have to keep going and pivot along.

2. Take full responsibility

Precisely it is a difficult and bumpy ride ahead, we have to take full responsibility to succeed; no excuses. Keep learning and pivoting through the ride.

When you think everything is someone else’s fault, you will suffer a lot. When you realize that everything springs only from yourself, you will learn both peace and joy. – Dalai Lama

There is an expiry date on blaming your parents for steering you in the wrong direction; the moment you are old enough to take the wheel, the responsibility lies with you. — J.K. Rowling

3. Invest in oneself first

Instead of spending on material goods and chasing after the latest models, invest in oneself to build and improve one’s earning and investing capacity first.

The best investment you can make is an investment in yourself. The more you learn, the more you will earn. — Warren Buffett

4. Start early

Having less earlier is having more later. The earlier we start, the earlier we know how much is enough, the earlier we save, and the earlier we towards achieving financial independence. Investing needs as long a time period as possible to compound for returns to run experientially.

The first rule of compounding: never interrupt it unnecessarily. — Charlie Munger

The big money is not in the buying or selling, but in the waiting. — Charlie Munger